Redesigning Clover’s SaaS Plans

Aligning Pricing & Features with Merchant Needs

Overview

Over 8 weeks, I partnered with senior leadership across Product, Strategy, & Marketing, to evaluate a pricing model, assessing merchant preferences, pricing perceptions, and feature relevance.

This research informed key decisions that redirectly shaped Clover’s SaaS plan structure, leading to:

Industry-specific bundles tailored to merchant needs

Clearer pricing for improved transparency and adoption

Greater feature flexibility to enhance plan customization

By addressing key merchant pain points, this research improved plan clarity, feature alignment, and adoption potential, ensuring Clover’s pricing model better serves its diverse merchant base.

Background

Clover’s SaaS pricing model evolved without a cohesive strategy, leading to:

Confusing pricing & feature differentiation

Merchant hesitation in choosing the right plan

Lower adoption & higher churn due to unclear value

To improve merchant satisfaction and conversion, Clover needed to align pricing, features, and messaging with user expectations, ensuring a clearer and more intuitive plan selection process.

Research Overview

This study examined how effectively the tiered pricing model aligned with merchant needs, focusing on:

Feature Relevance – Which features merchants valued most across segments

Plan Fit – Whether lower tiers felt too limited or upper tiers too complex

Value Perception – How clearly merchants recognized the benefits of each tier

Plan Clarity – Whether the structure supported confident, informed decisions

We conducted in-depth 1:1 interviews with 36 merchants across diverse industries, using concept testing and feature evaluation to explore their preferences and decision-making.

Challenges & Approach

Fast Synthesis, Continuous Alignment

Research ran in parallel with pricing strategy and product planning efforts. Rapid synthesis and frequent updates ensured stakeholders could act on insights in real time—informing plan design, feature packaging, and go-to-market decisions.Cross-Industry Complexity

Diverse merchant segments and varying levels of product familiarity made it essential to identify patterns that spanned industries and expertise levels.Sample Size Constraints

As a qualitative study, findings needed broader validation. The Product, Strategy, and Marketing teams triangulated research insights with:Market trend analysis

Competitive benchmarking

Quantitative sales and adoption data

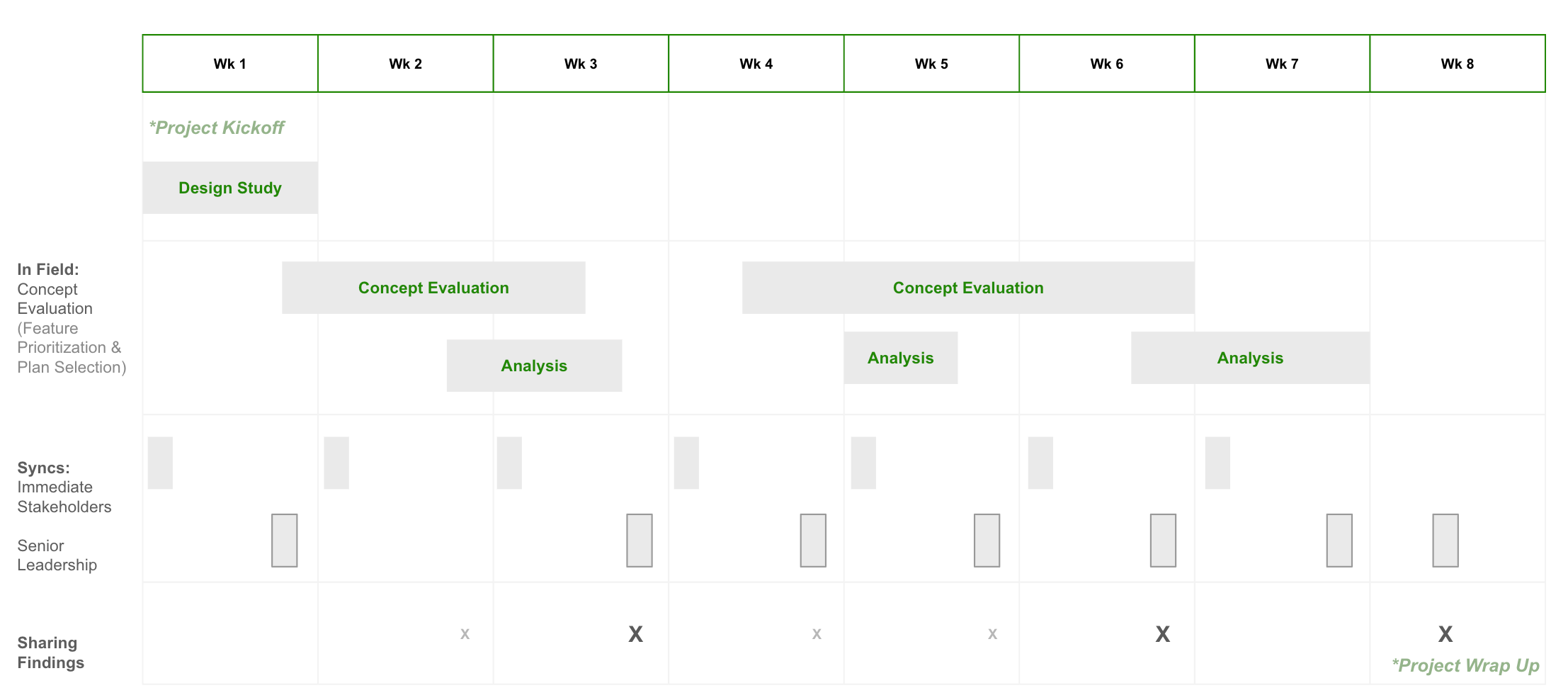

Timeline

Impact

This research directly influenced Clover’s pricing strategy, product packaging, and SaaS plan structure—resulting in a more scalable and industry-aligned offering.

Optimized SaaS Plans: Clearer tiers and prioritized features aligned with merchant workflows.

Simplified Pricing: Streamlined bundles reduced friction and improved decision-making.

Vertical Growth Plans:

Retail: Integrated inventory + eCommerce tools

Services: Added scheduling + business management features

Modular Add-Ons: Enabled flexible customization beyond rigid tiers.

Targeted Feature Investment: Focused on high-impact tools by vertical (e.g., restaurants, retail, services).

Improved Plan Communication: Sharpened messaging and plan comparisons to support confident selection.

Insights from this study also laid the groundwork for Clover’s service booking experience:[View Research on Clover’s Booking Experience for Service Appointments]

Findings

— At a Glance

Through interviews and plan evaluation feedback, we uncovered key barriers merchants face when selecting and using SaaS pricing plans across industries.

Merchants need more flexible pricing options

Rigid pricing tiers didn’t align with needs—low-tier plans felt too limited, while high-tier plans were seen as too expensive unless advanced features were essential.Plan selection is driven by industry-specific needs

Feature priorities varied significantly:Restaurants valued advanced order management and multi-menu support

Service businesses prioritized appointment scheduling and no-show protection

Retailers focused on inventory tools and online store integration

Unclear feature descriptions hinder decision-making

Merchants found it difficult to evaluate plan value due to vague or confusing plan descriptions.Merchants rely on external tools to fill feature gaps

Many businesses used third-party apps like QuickBooks to supplement missing POS capabilities, highlighting unmet needs within the native platform.

Owner, Martial Arts Gym

“Plan B covers most of what I need, and with the sales tax and payroll add-ons, it’s perfect for my business. It’s great to have everything in one place instead of switching between different tools.”

Owner, Quick Service Restaurant

“Plan A feels too basic for what I need, but Plan C is more than I’d ever use. Plan B with some add-ons is the best fit—it keeps costs reasonable while giving me flexibility.”

Reflections & Learnings

This project refined how I tailor insights for different audiences, shifting from Product & Design teams to Product, Marketing, and Strategy leadership.

Ongoing analysis & strategy collaboration helped bridge research and business decision-making.

Stakeholder engagement ensured research findings influenced product strategy in real time.

Presenting to leadership strengthened the connection between UXR and business strategy, sharpening my ability to deliver impactful, actionable insights.

This research not only improved Clover’s pricing model but also served as groundwork for future evaluations, ensuring ongoing alignment with merchant needs.